Why McLean Equity Research

In today's data-driven world, most financial analysis is built for lenders—not equity investors. McLean Equity Research was founded to correct this imbalance. Our journey began with one insight: true investor value is rooted in understanding the real, sustainable cash flow of a business—not accounting illusions. We exist to empower long-term investors with tools that reflect the actual economics of a company.

We believe that Owner Earnings—not accounting profit—should guide equity valuation. We believe in protecting investors from speculative traps. We believe in truth over trends, and real cash flow over artificial earnings. We reject short-termism, and we champion clarity, prudence, and discipline in investing.

Our methodology is inspired by investing legends and thought leaders: Richard Sloan's pioneering work on Accrual Ratios revealed how companies with high accruals tend to underperform—highlighting the importance of focusing on real, cash-based earnings. We also draw from Peter Lynch's Fair Value principles, Ben Graham's Margin of Safety, and Warren Buffett's emphasis on Owner Earnings. These icons represent more than names—they embody our values: clarity, sustainability, and long-term thinking.

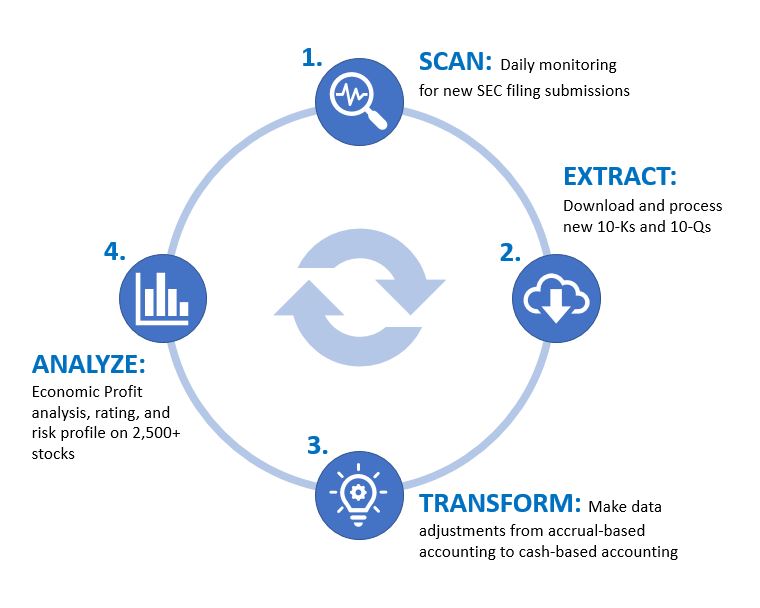

Our approach is defined by repeatable, disciplined processes: We calculate Owner Earnings, factoring in the cost of capital to get a real, investor-focused view of profitability. We rate companies based on their Owner Earnings profile: Conservative, Neutral, or Speculative. We use the EV/IC ratio (Enterprise Value / Invested Capital) to assess valuation and investor expectations. We compare growth against intrinsic value, avoiding forecasts or earnings hype. These steps are rituals—not guesses. They help our clients avoid noise and focus on substance.

Most of Wall Street still clings to accounting profit—metrics like net income or EBITDA that can be manipulated and don't reflect the full cost of capital. They ignore sustainability and reward surface-level growth. These are the nonbelievers. We challenge their conventions, because we've seen the confusion they cause.

We speak the language of Owner Earnings, Intrinsic Value, EV/IC, and Risk-Adjusted Return. We avoid buzzwords like "beat expectations" or "adjusted EBITDA." Our vocabulary is sacred because it reflects what matters: real returns, not accounting tricks.

Richard McLean is the founder and guiding voice of McLean Equity Research. With decades of experience, his mission has always been to simplify investing, protect capital, and empower others to invest with confidence. He built this firm not to predict markets, but to help investors avoid pitfalls and make rational, evidence-based decisions.

Our Promise to You

We don't speculate. We don't forecast. We provide clarity in complexity, and discipline in uncertainty. In a world of noise, we help you find the signal. We believe the best investments are measured, not hyped—and that the best portfolios are built on Owner Earnings and real value.

Join us. Invest with insight.

Sign Up Today